Brands in the Consumers Mind

Mapping Brand Image in Consumers Brains with Visual Templates

Businesses spend considerable resources on brand-building. One of their goals is to create vivid and consistent mental associations in consumers’ minds through advertisements and marketing campaigns. For example, a cereal brand may want its customers to associate the brand with the idea of a loving family around the breakfast table; a beer brand may try to evoke images of a good time hanging out with cool friends.

How do we know whether consumers have the “right” image associated with a particular brand in their minds? Traditionally, brand managers have asked consumers to describe a brand’s image in their own words, but such a qualitative approach is not very scalable, and verbalization of an image through self-report is inherently difficult. In our research, we tried to look directly into the consumer’s brain using functional magnetic resonance imaging (fMRI). We wanted to see if we could decode brain signals that might give marketers insight into how brands are perceived in the eye – and inside the mind – of the beholder.

Approach

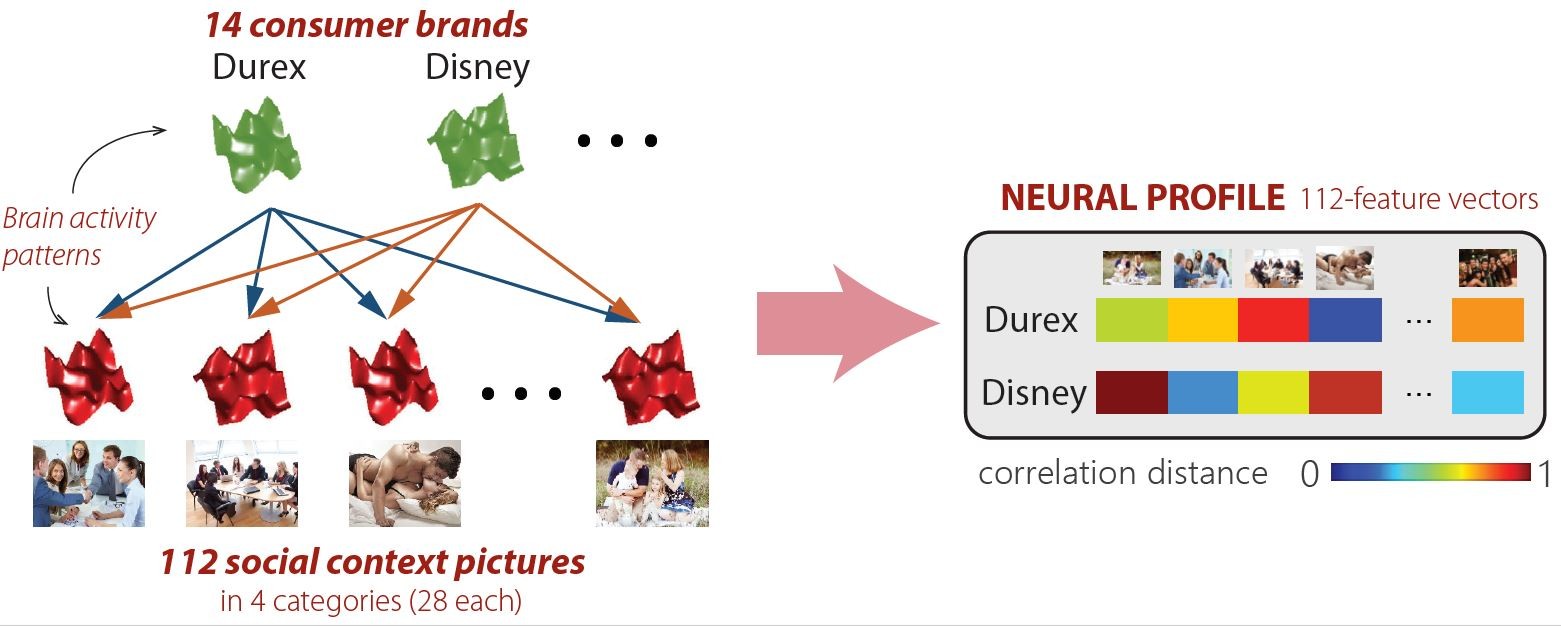

We invited 38 individuals to participate in our study. In the first part of the study, we provided them with a list of 14 well-known consumer brands; for each brand, we asked them to visualize an image in their mind, without verbalization, that would fit their perception of the brand. In the second part of the study, participants viewed a series of 112 pictures depicting various scenarios, such as family gatherings, parties, people working in offices, etc. During the whole process, we recorded their brain activities using fMRI.

We then compared brain activities recorded during brand image visualization and during picture viewing. By computing the brain signal pattern similarities between the two, the content of the participants’ brand image visualization can be decoded. This is a process we call “neural profiling” (Figure 1). Obtaining neural profiles of brand images should help answer three questions. First, do neural profiles correspond to what the participants think about those brands? Second, can they tell us anything about the relationships between different brands? Third, can they tell us anything about the strength of the brand’s image?

Figure 1

Results

Using machine learning algorithms, we compared brain signals during brand image visualization and during picture viewing, resulting in a similarity measure between a brand and each social context depicted in

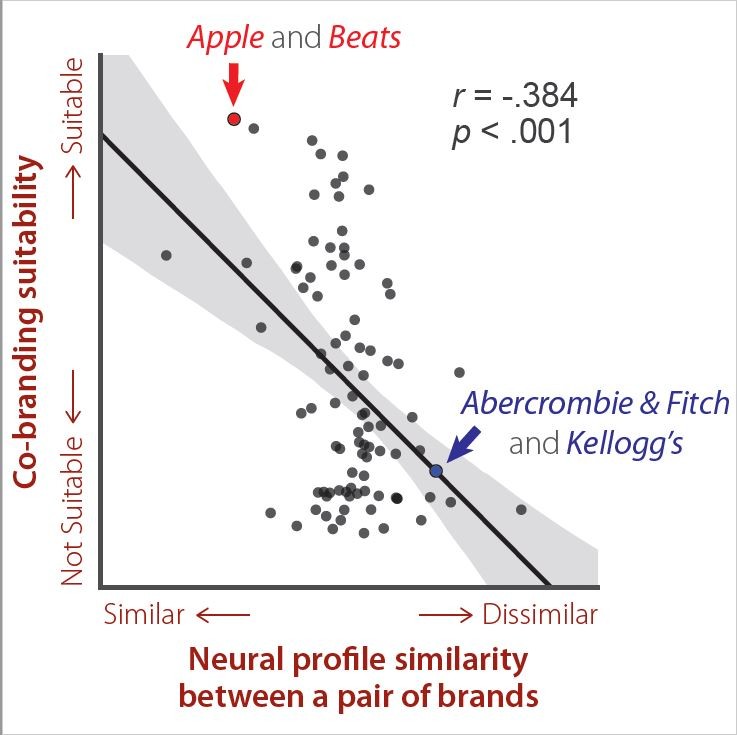

the pictures. The overall pattern of similarity with the different contexts we refer to as the brand’s neural profile. We found that the neural profiles correspond with what the participants report about these brands; that is, e.g., when they say that a particular brand is more like a “family” brand, we observed that their brains, when visualizing that brand, generated similar signals as if they were viewing pictures depicting family scenes. What can we say about brands with similar neural profiles? When we put two brands with similar neural profiles together and asked a separate group of consumers, they reported that these two brands are more suitable for co-branding; conversely, brands with different neural profiles are judged to be bad partners in a potential co-branding exercise (Figure 2A).

Figure 2A

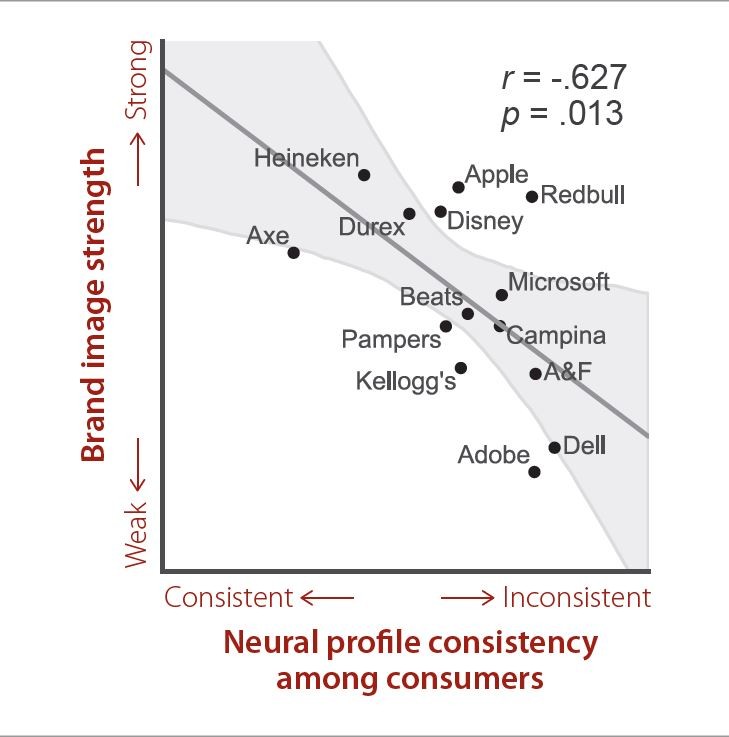

Lastly, we explored the implications of neural profile consistency – that is, whether different consumers’ brains react in a similar fashion (i.e., evoke similar neural profiles) when visualizing the same brand. For each of the 14 brands we tested, we calculated a consistency measure of the neural profiles generated across participants. Separately, we asked a group of consumers to rate the 14 brands’ image strength (by asking, e.g., how easily they can recognize the brand among competing brands, and how easily they can recall advertisements of the brand). We found a correlation between neural profile consistency and brand image strength: when a brand generates similar neural profiles among different consumers, it is more likely to be perceived as having a strong image (Figure 2B).

Figure 2B

Conclusions

In this proof-of-concept study, we attempted to extract consumers’ knowledge about a brand’s image without asking them to articulate in words but by observing their brain activities. This demonstrates the promising potential of harnessing the brain for consumer insights, especially those involving hard-to-describe sensory experiences. The neural profiling approach offers great flexibility to brand managers: they can choose to measure very specific visual (or other sensory) associations that they believe to be crucial in the market in which they operate. More broadly speaking, neuroimaging methods such as fMRI or electroencephalography (EEG) provide an alternative, potentially more powerful, way to access the consumer’s mind, in addition to traditional methods such as surveys and focus groups.

Mind-reading may sound like science fiction, but recent developments in neuroscience research have proved that by extracting information from brain signals using fMRI or EEG, it is possible to infer something about a person’s thoughts or mental experience. While such research is still in its infancy, it may eventually prove to be a valuable addition to the neuromarketer’s toolbox.

CONTACT INFORMATION

Rotterdam School of Management

Department of Marketing Management www.rsm.nl

This article was originally published in the Neuromarketing Yearbook. Order your copy today!