How to Predict the Future Perspective of Retail Tenants?

Anchor tenants in a mall are tenants that generate the highest turnovers and traffic and are therefore of the greatest value to the shopping mall. Normally the value of a tenant is determined to look at financial results of the past, but how can you predict the future perspective?

This article presents the results of a study conducted for the retail industry in Poland. It was held on the premises of shopping malls with the principal aim of identifying the most desirable tenants. The data gathered was essential to identify the brands with the greatest potential to build the positive image of the shopping mall and was taken into account when planning the business strategy of both actual and planned investments.

To answer the research question, reaction time methodology was used, which represents the new generation of survey research. From the respondent’s point of view, it is nothing but a short and user-friendly questionnaire that can be completed on any mobile or stationary device. Nevertheless, this simple-looking tool measures not only opinion but more importantly, the emotional certainty of this opinion. The certainty is revealed by the reaction time. RT is measured in milliseconds, individually for each participant, to be matched with his or her individual baseline which determines whether the answer is fast (high certainty) or slow (indicating hesitance). High certainty will more probably be transferred into actual behavior as proven by academics in the past, including in the seminal works of Russell Fazio in the 80s and 90s.

Reaction time was chosen, because the so-called ‘ceiling effect’ was anticipated. This effect is a very common phenomenon when consumers are asked about their needs and expectations – it occurs that on a declarative level most tested motives get a high, positive evaluation. This eventually makes it impossible to unequivocally point out the most relevant and important ones.

The consumer’s voice...

Over 800 respondents of different age, gender, family status, income and mall visiting frequency answered whether the presented brand was desirable in their ideal shopping mall. The study tested brands from various categories, including fashion and supermarkets.

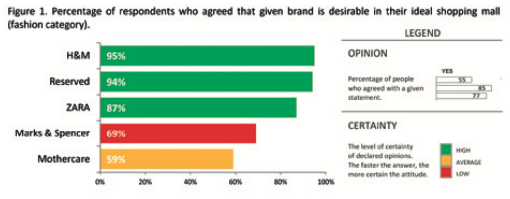

In the fashion category brands such as ZARA, H&M, Reserved (a rapidly developing Polish chain brand), Mothercare and Marks & Spencer were evaluated. On a declarative level, H&M and Reserved were awarded the highest scores, with ZARA in third place. High emotional certainty proved that the results mentioned above reflected consumers’ true attitudes. Despite the fact that participants declared that the two remaining brands were also on their wish list, reaction time analysis showed hesitance towards them. In this case we can say that declarations and certainty go hand in hand.

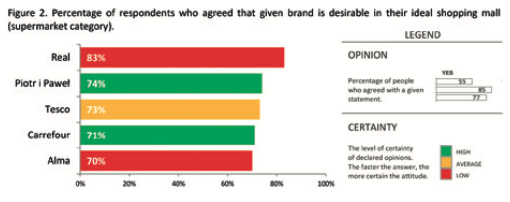

In the supermarket category, respondents had to evaluate trademarks such as Real, Piotr i Paweł, Tesco, Carrefour and Alma (a Polish, upmarket supermarket brand). Respondents’ declarations indicated that Real was the most desirable tenant. The remaining brands’ scores made them impossible to rank – there was no significant difference between them as declarative “Yes” answers ranged from 74%-70%. Reaction time enables to “emotionally filter” the results and separate the opinions that were strong from those that were only wishful-thinking. Reaction Time analysis left no doubt: the high level of declarations supporting Real was not strong on a subconscious level. This was not the only brand raising doubts amongst consumers. Taking into account a low emotional certainty level, Alma and Tesco were also on the list.

.... is the voice of upcoming changes

It is now worthwhile to examine the market condition of the tested brands five years after the study. In the fashion category, H&M, Reserved, and ZARA, were during the study indicated as must-haves both on a declarative and emotional level, are currently doing great, and can be recognized as well-established trademarks. The brands that consumers weren’t emotionally sure of in 2012 lost their leading position and have disappeared from the Polish market. Marks & Spencer closed its last store five years after the study and Mothercare closed all its stores in Poland the year before.

A similar situation occurred in the supermarket category. Real, the undisputed leader according to declarative results, did, at the same time, evoke doubts on an emotional level and was taken over by the Auchan Group in 2014. What is more, Real was not the only brand that disappeared from the market soon after the study – two years later Alma was also declared bankrupt.

It is worth keeping your ears to the ground

So, if we look at these results, can we state that five years ago we knew exactly what would happen to Mothercare, Marks & Spencer, Real and Alma? Taking into consideration the relatively long period of time, the introduction of new competitors, technological development and constantly changing consumer trends, such a statement would be contentious. We realized that there was a serious hidden issue. Traditional research measuring consumer satisfaction appeared to tell us that the market was buoyant. However, revenues were steadily falling. A few years before Real and Alma’s financial problems became common knowledge, reaction time indicated these problems were in the pipeline.

Ultimately it is worth questioning whether it is the predicted turnovers, not consumer opinions, that should be the decisive factor of all potential tenant negotiations? Such results should certainly be considered as an additional argument while discussing new contract terms and conditions. This additional insightful knowledge could be highly beneficial to both landlords and tenants.

CONTACT INFORMATION

NEUROHM

www.neurohm.com

Contact: Michal Matukin michal.matukin@neurohm.com

This article was originally published in the Neuromarketing Yearbook. Order your copy today